Since its inception in 2009, Bitcoin has defied all odds, transforming from an obscure digital currency to a dominant force in the global financial system. As commercial banks continue to grapple with challenges such as economic recessions, bailouts, and inflation, Bitcoin’s decentralized and secure nature has made it an increasingly attractive alternative. This article traces the history of Bitcoin and explores how its position in the global financial system is poised to become even stronger.

The History of Bitcoin

Bitcoin was introduced by an anonymous developer or group of developers known as Satoshi Nakamoto in 2009. It was created as a response to the 2008 global financial crisis, which exposed the flaws in traditional banking systems and the danger of centralized control. Bitcoin was designed as a decentralized, peer-to-peer digital currency, which would allow users to make transactions without the need for intermediaries like banks or financial institutions.

As Bitcoin gained momentum, it quickly became a popular choice for various online transactions. It enabled users to bypass traditional financial institutions and make secure, low-cost, and fast cross-border transactions. Over time, Bitcoin evolved from a niche currency to a widely accepted store of value and investment asset.

Bitcoin’s Strengthening Position in the Global Financial System

- Decentralization

One of the key factors contributing to Bitcoin’s growing prominence is its decentralized nature. Unlike traditional banking systems, which rely on centralized institutions, Bitcoin operates on a network of computers known as nodes. This decentralized structure reduces the risk of a single point of failure and ensures that no single entity can control or manipulate the system. This is particularly appealing in times of economic uncertainty, as it protects users from the risks associated with central bank policies, government interference, and financial institution bailouts.

- Security and Transparency

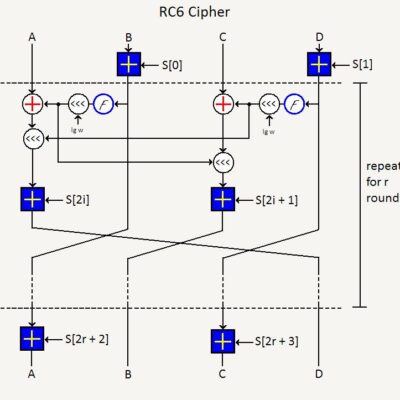

Bitcoin’s underlying technology, blockchain, offers a secure and transparent way of recording transactions. Every transaction made on the network is verified by multiple nodes and added to a public ledger, which can be viewed by anyone. This creates a highly secure and tamper-proof system that fosters trust among users. As commercial banks struggle to regain public trust after numerous scandals and bailouts, Bitcoin’s transparent nature makes it an increasingly attractive alternative.

- Limited Supply and Inflation Hedge

Bitcoin’s supply is capped at 21 million coins, which means there will never be more than that in circulation. This limited supply makes Bitcoin resistant to inflation, as its value cannot be diluted by an increase in the money supply. As governments worldwide continue to implement quantitative easing measures and engage in currency debasement, Bitcoin’s deflationary nature has emerged as a strong hedge against inflation, further solidifying its position in the global financial system.

- Growing Acceptance and Institutional Interest

Bitcoin’s increasing acceptance among businesses, consumers, and institutional investors has played a significant role in strengthening its position in the global financial system. This growing acceptance can be attributed to several factors:

a. Payment Adoption

As the popularity of Bitcoin has grown, many large companies and small businesses alike have begun to accept it as a form of payment for their goods and services. This includes major companies such as Microsoft, Tesla, and Overstock, as well as smaller online retailers and brick-and-mortar shops. By accepting Bitcoin, these businesses not only cater to the growing user base but also benefit from lower transaction fees, faster payment processing, and access to a global customer base.

b. Corporate Treasury Adoption

In addition to being used as a form of payment, many companies have also started to hold Bitcoin as a reserve asset in their corporate treasuries. This trend was popularized by MicroStrategy, a publicly-traded company that made headlines by investing billions of dollars in Bitcoin. Other companies, such as Tesla and Square, have followed suit, further validating the legitimacy of Bitcoin as a financial asset and store of value.

c. Institutional Investment

Institutional investors, including hedge funds, pension funds, and asset managers, have shown a growing interest in adding Bitcoin to their portfolios. This interest can be attributed to the digital asset’s potential for high returns, diversification benefits, and ability to hedge against traditional market risks. The entry of these large investors into the Bitcoin market not only adds credibility to the asset but also contributes to its increasing liquidity and price stability.

d. Financial Products and Services

As Bitcoin’s adoption continues to grow, various financial products and services have been developed to cater to the needs of institutional and retail investors. These include Bitcoin exchange-traded funds (ETFs), futures, options, and other derivatives. Moreover, traditional financial institutions, such as banks and brokerage firms, are also exploring ways to offer Bitcoin-related services to their clients. These developments further integrate Bitcoin into the mainstream financial system and make it more accessible to a broader range of investors.

e. Regulatory Clarity

Regulatory clarity has been instrumental in facilitating the growing acceptance of Bitcoin among businesses and institutional investors. As governments and regulatory bodies worldwide have begun to recognize the importance of cryptocurrencies, they have started to develop regulatory frameworks to govern their use. This clarity provides businesses and investors with the confidence to engage with Bitcoin and other cryptocurrencies, knowing that they are operating within a legally compliant framework.

In conclusion, the growing acceptance of Bitcoin among businesses, consumers, and institutional investors highlights its strengthening position in the global financial system. This acceptance is driven by factors such as payment adoption, corporate treasury adoption, institutional investment, the development of financial products and services, and regulatory clarity. As these factors continue to evolve, Bitcoin’s role in the global financial system is set to become even more prominent.

The history of Bitcoin has been marked by its rapid rise from obscurity to becoming a key player in the global financial system. Its decentralized nature, security, transparency, and resistance to inflation make it an attractive alternative to traditional banking systems, especially in times of economic uncertainty. As commercial banks continue to face challenges such as potential bailouts and eroding public trust, Bitcoin’s position in the global financial system can only grow stronger.